Inflation in simple terms, is the rate of increase in prices over a given period of time.

Though the definition of Inflation looks simple and straight forward, Inflation itself has very deep impact on our everyday life and global economy. As the prices of good increase over the time, it reduces the purchasing power of common man and forces us to compromise for less by paying more in the long run.

Inflation is not a new concept to us. It existed from centuries. We don’t experience any inflationary effects in overall rising economies, on the contrary, inflation becomes one of the hottest topic everywhere during economic crisis and imbalances. The real impact of inflation is only experienced by everyone when the growth of purchasing power lags the significant high prices of consumer goods. This is when, everyone starts feeling the pinch of inflation and the feeling of not having enough money to maintain the same lifestyle, comes into reality.

“Inflation is like toothpaste. Once it’s out, you can hardly get it back in again.” — Karl Otto Pohl

What causes Inflation?

Inflation is simply the increase in the prices of common goods over the time. There are several factors that contribute such price increases. I am listing some of the most common factors that are key contributors of inflation.

Growth in Money Supply

This is the main root cause of inflation. Whenever the government increases the money supply, the unit value of the currency goes down. This decline in currency value, results in lowering the purchasing power and causes the increase in the prices.

Imbalanced Demand & Supply

An out-of-balance between the demand and the supply of consumer goods also effects the price changes. Whenever there is an overall reduction in supply due to natural disasters or high energy prices, it triggers the price increases of the goods to fulfill the consumer demands. Whenever there is more demand than the supply of goods, it simply triggers the increase in the prices of the goods.

Government Policies

Sometimes, in order to boost overall demand and economic growth, the government provides incentives like low interest rates and increased government spending. However, when such increase in demand starts to exceed the production capacity, the overall economy starts getting the high inflationary effect due to the increased prices.

Consumer’s Expectations

Consumer expectations also play a key role in inflation. When people or corporations anticipate higher prices, they set their expectations for higher salaries or price adjustments. If such expectations could not be met due to other economic reasons or otherwise, it pulls back consumer spending and thus eventually creating inflationary effects.

“Inflation is the one form of taxation that can be imposed without legislation.” — Milton Friedman

How do we measure Inflation?

Inflation is measured simply by comparing the cost of living of an average consumer every year. Government agencies usually conduct extensive research and surveys to calculate the cost of a basket for inflation tracking. The basket contains commonly purchased items by consumers and track them over time. Some of the common household items include household items like food prices, clothing, rent & mortgages, gas prices, basic needs of consumer and other similar goods. The U.S. Bureau of Labor Statistics (BLS) that tracks the cost of consumer goods in USA, has a list of over 200 household items in the basket. The cost of this basket relative to a base year is called Consumer Price Index (CPI), and the percentage change in the Consumer Price Index (CPI) every year is called Inflation.

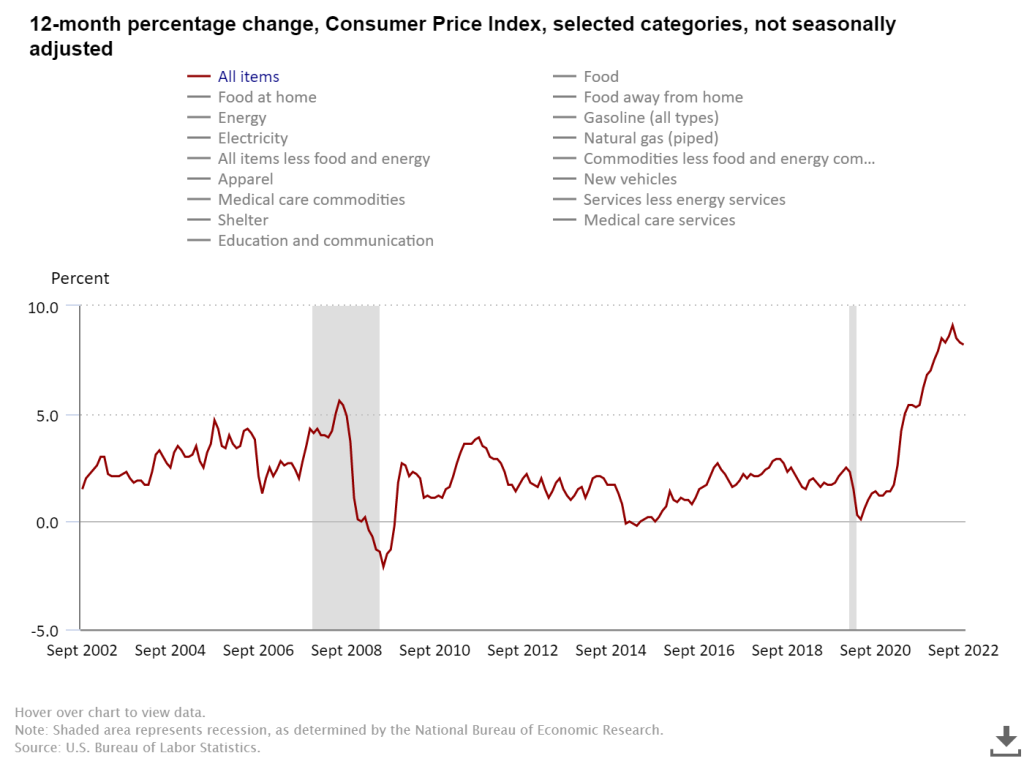

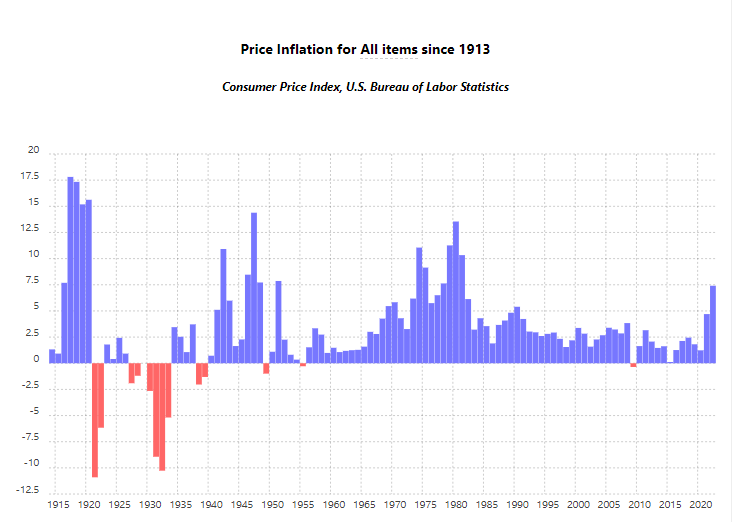

These charts show some of the most common households items used in the basket by U.S. Bureau of Labor statistics as well as the Inflation over the years. I am listing some of the key information based on these graphs below.

- The basket used for pricing by U.S. Bureau of Labor Statistics (BLS) contains common household items like food, gas, clothing, vehicles, rent / mortgage, educational expenses, medical care services, utilities and many more…

- The average inflation rate in the United States, based on inflation rate captured from 1913 to 2022, is 3.15%

- The United States has experienced several high inflation rate periods with inflation rates over 10%.

- Year 1917-1920 had inflation rates in the range of 15%-18%

- U.S. economy experienced inflation rates above 10% in few years like 1942, 1947, 1975-1981

- The U.S. inflation rate has been consistently under 5% for the long period between 1985 – 2021

- Year 2022 is the most recent year when U.S. inflation rate spiked again to the level of 1980s. That indicates the level of inflation rates were pretty consistent for over 40 years, before going up again in 2022.

Common Effects of Inflation

Like everything else, Inflation also has positive and negative effects. These effects are purely based on the circumstances, consumer’s confidence and the pace of changes w.r.t. overall economic growth. I have created a side-by-side comparison of the positive and negative effects of inflation for easy references.

| Positive Effects of Inflation | Negative Effects of Inflation |

|---|---|

| The companies benefit by selling products at higher prices and thus experience better profits. | The consumer pays higher prices for the goods and experience falling purchasing power. |

| Investors receive better returns on their investments. | Inflation erases the real value of holding assets like cash or bonds. |

| Inflation helps to increase the price of tangible assets like real estate and commodities, which helps owners of such assets to sell at higher prices. | The buyers of tangible assets like real estate and commodities, are forced to pay higher prices in inflationary markets. |

| Moderate inflation enables labor market to reach equilibrium faster. | Unexpectedly high prices and low purchasing power during inflation, often leads to massive demonstrations and revolutions. |

| Inflation leads to increase in capital investments. | High Inflation serves as a hidden tax on currency holdings. |

| Inflation triggers governments and corporations to increase cost-of-living allowances and wages. | Higher levels of inflation are disastrous and triggers governments to enforce difficult and painful policy measures to bring back inflation. Such policies lead to economic disorders and increased unemployment at times. |

| Moderate inflation encourage consumer spending instead of saving with a notion that purchasing power of money will fall over the time. Such increase in spending leads to growth in economic activities. | Inflation creates increased inequality in income distribution. Businessmen and corporations experience an increase in profits. However, people with fixed-income based assets experience a steep decline in their real income. |

Controlling Inflation Strategies

“[U]nemployment is … a side effect of the cure for inflation.” — Milton Friedman

The policymakers and government entities apply different types of disinflationary policies to reduce the inflation over time. These policies vary based on the current economic conditions and possible causes of inflation. I am listing some of the most common strategies and policies that are frequently used by policymakers to tame the high inflation and bringing it back to the normal levels.

- Usually central bank increases the interest rates to reduce the economy’s money supply. The underlying assumption for this strategy is that with high borrowing costs, there will be fewer borrowers. Fewer loans translate to decrease in bank deposits and money supply.

- Wage and Price controls – This is another common approach used by policymakers to fight the rising inflation. By controlling the prices and wages, the authorities try to make investments in such consumer goods less attractive. This approach helps to avoid the higher prices of consumer goods that leads to higher inflation.

- In certain circumstances, recession is also used as an efficient way to fight inflation. Government entities try to create policies that lead to higher unemployment and let the economy go into temporary recession. Such measures helps to reduce the high demand over time and thus leads to possible reduction in inflation. This kind of strategy sometimes lead to long-term severe recession instead of a temporary short-term recession, which eventually does more harm to the country.