Inflation is currently on the rise and it is one of the biggest concern globally due to rising prices and declining purchasing power across the world.

As I mentioned in my previous article about Inflation, rising prices of consumer goods is one of the biggest threat of rising inflation. It means that we have to pay more to maintain the same life style. In simple words, if we maintain the same level of spending, then we might not be able to buy all required items we were able to purchase in the past. That means, in order to keep the balance, we have to take one of the two possible actions –

- Cut down our basic needs and stay within the same spending. However, there is only a certain extent until when we can cut down the basic needs. When that limit is reached, we will start experiencing the impact of inflation.

- Increase our spending to meet the same level of basic needs. Again similar to the scenario 1, there is only a certain limit to extend our spending before we max out.

Hopefully by now, we understand the direct impact of Inflation on a common man. This is one of the reason why it is absolutely necessary for governments to take appropriate actions to stop or control inflation.

While policymakers can try their best to put all precautionary measures to control inflation, it is entirely on us to ensure that we and our families, are not impacted drastically from the evil effects of inflation. In this article, I am going to list some of the ways that can help us to minimize the impact of inflation on our daily life.

If we google the phrase, “Protection against Inflation” , we will get millions of search results explaining how to protect ourselves against Inflation. This is how I also used to search and read about this topic. But soon I realized, most of the search results are from big financial companies, that are describing different techniques and promoting their financial products that can be used to hedge against rising inflation. It sure helps to many of us, who have a hefty financial portfolio in stock market, 401(k) and other similar investments, but sadly, it does not help others, who only have minimal or no exposure to financial markets but experiencing the hardest hit of rising inflation to meet their basic needs. I, myself, belong to this latter category (a.k.a. Main Street America), where there is a real need of awareness of how to combat the dreadful effect of rising inflation without panicking.

To help everyone, in this article, I will be writing how to safeguard ourselves against inflation, that will aim to help both categories of people. I strongly believe, such broad level of awareness will not just help us , but will also give us an opportunity to help others who might belong to different kind of financial stress and pressure.

Everyday Techniques to safeguard against Inflation

Under this section, I am going to list some of the most common practices, that we can try on everyday basis to help us and the community to fight against rising inflation and its effect.

Cut Your Spending

This is something easy to say but hard to follow. But it can easily be done by following simple steps.

- Think twice before buying goods and services, instead of buying spontaneously just because it is one of the weekly or daily sale item, without realizing we might not need that at all.

- Always ask yourself what is the real need of the item you are about to buy. If you can’t think of any good reason to buy , then its worth not buying such item.

- Shop Smart using coupons , deals and most importantly by shopping only what you need. You should be shopping based on your needs and NOT based on the external factors like weekly sales, neighbors buying habits or simply the status symbol.

Earn Side Income

We all know that rising inflation reduces the purchasing power and makes it difficult to keep up with the rising prices. Try to look different ways that you can try to earn side income. It will not replace your main income but it will definitely help to pay some of our bills or reduce rising price pressure. Everyone of us can think of some of our skills or passion, that can be easily transformed into a way to earn side income. It could be anything you might enjoy like music lessons, trainer, or simply helping someone. You can read the article Ways to Earn Side Income , where I have listed some of the most common ideas of earning side income.

Keep Emergency Funds

Inflation comes with many financial stress over the time. Some of the severe impacts of rising inflation on common life includes – potential of job loss, soaring prices, reduced affordability, financial and mental stress. Though we cannot avoid these factors, we can definitely keep us prepared to handle such situations if we have some emergency funds available, when we need them the most. I understand, this might not be a feasible solution for everyone but this is definitely a blessings to those who are able to accumulate some emergency funds for rainy days.

Consolidate your debt

Consolidating your debt plays a major role when we try to make ourselves financially strong. It helps to review our outstanding revolving debts and also gives us an opportunity to potentially eliminate unwanted debts. There are various debt consolidation services, who plan to work based on individual needs, to consolidate their debts and set a single monthly payment for all debts. I highly recommend to consider taking services from such debt-consolidation services provided by reputed companies to help yourself in the event you feel you need debt consolidation.

Don’t Panic

One thing I can also add based on my own experiences is not to panic. It is very common to panic ourselves when we feel tight budgets, mass layoffs, unable to meet the basic needs or when our investment portfolio and 401(k) lose values. These are all very common outcomes of an inflationary market and unfortunately it is beyond our control. The only thing we can do is to panic ourselves and do unwanted harm to us and the community. Therefore try not to be panic and instead of that understand this is not in our control and let is settle by itself with time.

A more wholistic approach to fight Inflation

In the earlier section, I listed some of the behavioral approaches which we can adopt to safeguard ourselves against Inflation. In this section, I am going to list additional strategies that play significant roles in inflationary market conditions. Following such strategy will always prepare us to stand firm in such tough periods of financial meltdowns.

Real Estate Investments

Historically, real estate based investments have always helped everyone to combat inflation. Tangible assets like homes, investment homes and other real estate based investments become more valuable with time and help us to stay put during rising inflation periods. If you own such real estate based investments, you are already hedging yourself against inflation over the time. Rental Income from such investments also give a good cushion to us , given the fact that rents also increase when prices of the good soar with rising inflation.

Inflation-resistant Diversifiers

Diversification is the key to any investment portfolio. A well diversified investment portfolio with a mix of stocks and bonds provide a good protection to everyone in financial markets. In additional to that, there are additional investment tools which are built specifically to protect ourselves from rising inflation. Adding these instruments in your investment portfolio, gives additional cushion and protection against inflation. Some of these inflation-resistant diversifiers include the following:

- TIPS : TIPS is short form of Treasury Inflation Protected Securities. TIPS provide a very effective way to protect our investment in special government bonds, that are indexed based on inflation. Such special kind of government bonds are considered one of the safest financial instruments to keep our investments protected against rising infltion.

- Floating Rate Notes: Floating rate note (FRN) is a type of bond that has a variable interest rate. The interest of such notes/bonds are tied to LIBOR or the Fed funds rate. Such unique feature of this financial instrument, makes it one of the best tool to diversify our investment portfolio during inflationary periods.

- I Bonds: Another wonderful inflation resistant strategy that an investor can adopt is to invest in I Bonds. These are U.S. savings bonds that earn interests based on a fixed interest rate and the current inflation rate. These are one of the most effective risk-free investment for everyone to protect our wealth from rising inflation.

- Invest in growth based industries: The growth based industries often benefit from inflation. That is partly because the rising prices help such industries to ripe more benefit. In addition to that , such industries also pay periodic dividends. Investments using stocks and ETFs in these industries are always recommended. Some of these industries include the following:

- Energy

- Food

- Healthcare

- Technology

- Construction Materials

- Precious Metals

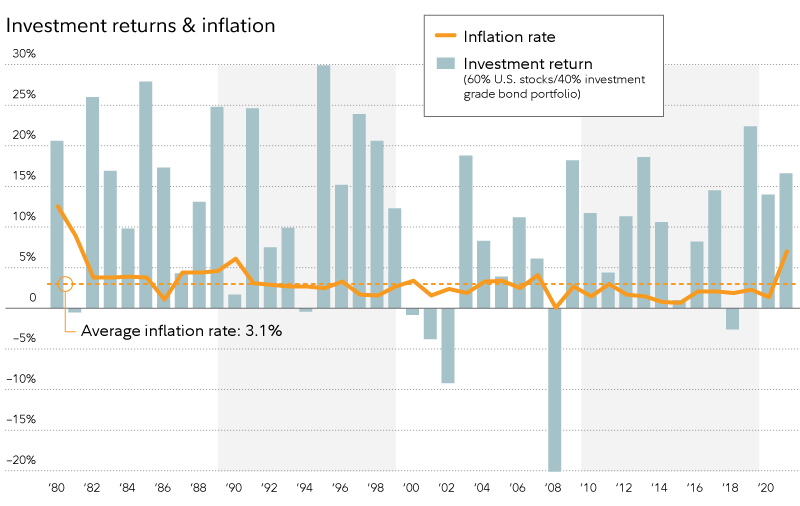

The chart below clearly shows how a well diversified portfolio with inflation resistant diversifiers, almost negates any effect of Inflation in long term investment.

Lock High Interest Earning CDs

When inflation hits, the policymakers try to control inflation by raising interest rates. Such high or rising interest rates produce a very good opportunity to lock into some of the high interest bearing CDs for your savings. By locking ourselves into such high-interest earning CDs, we can minimize the risk of losing future purchasing power of our savings.

Buy Gold & Gold based ETFs

GOLD has always been one of the safest investment around the world. In all tough times and during financial turmoil, majority of the investors invests in Gold as a safe-heaven asset. These days investments in gold, can be done by directly buying gold as well as using gold based ETFs. Both these options provide a very good protection of investor’s wealth and is considered one of the best hedging strategy against rising inflation.

Cryptocurrencies

Cryptocurrencies like Bitcoin (BTC) or Ether (ETH) are still relatively new type of investment tools. However they have shown a great appreciation in terms of value growth in the past. But these instruments are very volatile. Their volatile nature gives them a significant edge against other traditional investment tools in both upside and downside trends. A careful and thorough analysis of such cryptocurrencies by an experienced investor, might provide a good hedge against inflation. I will still warn everyone to exercise extra precaution while investing in crypto currencies because they are still relatively new, contains high risk and it might not be suitable for every investor.

Enhance Your Skills

This is one of the most important point to keep us ready and enjoy inflation proof life. Every time we experience financial trauma, new tools and strategies evolve. In order to adopt such new strategies, companies need highly skilled employees. Therefore it is absolutely important for us to enhance our skills and ready for such new opportunities when they arrive. They help us to earn higher income due to the demand of high-skilled employees and also provide us a job-protection during uncertain times because of the high demand.